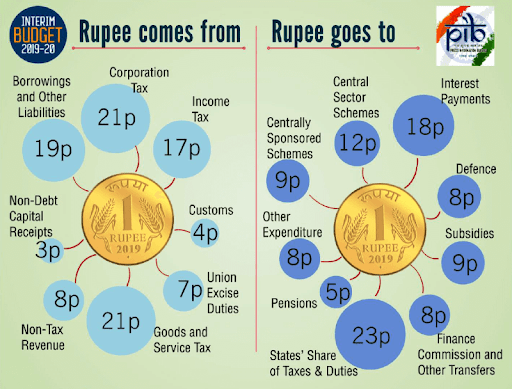

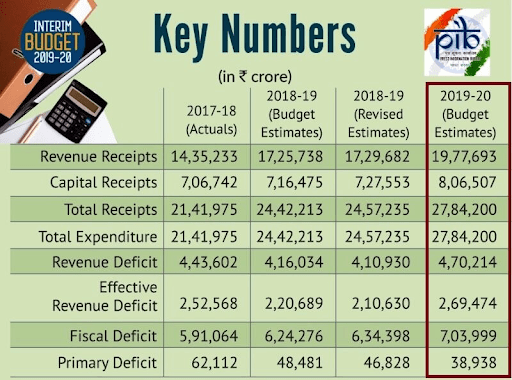

Tapassu chesthe devudu varam isthado ledo teliyadu kani elections ki mundu mana Politicians matram definite ga varalu istaru. Anduku oka fine example ninna Lok Sabha lo Piyush Goyal pravesha pettina Interm Budget 2019. Main highlight of the the budget is Income Tax Limit which is Raised to 3 lakhs to 5 lakhs, which is mostly going to benefit middle class people in the country.

Not only Income tax benefit but whole Budget directly or indirectly absolutely fetches to middle class families, farmers, unorganised workers, senior citizens and small taxpayers.

Take a look at ‘Modi Last Ball Pe Chakka’ Budget 2019 Highlights.

1. No income tax for earnings up to ₹5 lakh

2. Individuals with gross income of up to ₹6.5 lakh need not pay any tax if they make investments in provident funds and prescribed equities.

3. Standard tax deduction for salaried persons raised from ₹40,000 to ₹50,000

4. TDS threshold on interest on bank and post office deposits raised from ₹10,000 to ₹40,000

5. TDS threshold on rental income increased from ₹1.8 lakh to ₹2.4 lakh

6. I-T processing of returns to be done in 24 hours

7. Within the next 2 years, all verification of tax returns to be done electronically without any interface with the taxpayer

8. Package of ₹6000 per annum for farmers with less than 2 hectares of land. Scheme to be called Pradhan Mantri Kisan Samman Nidhi.

9. Vande Bharat Express, an indigenously developed semi high-speed train, to be launched

10. One lakh digital villages planned in the next five years

12. Fund allocation for the Northeast region increased to ₹ 58,166 crore, a 21% rise over last year for infrastructure development

13. Anti-camcorder regulations to be introduced in the Indian Cinematograph Act to prevent piracy and contact theft of Bollywood films.

14. Single window clearance for Indian filmmakers.

15. 25 percent of sourcing for government projects will be from the MSMEs, of which three per cent will be from women entrepreneurs.

16. National Artificial Intelligence portal to be developed soon

17. ESI coverage limit increased to ₹ 21,000. Minimum pension also increased to ₹ 1000.

18. Mega pension scheme for workers in the organised sector with an income of less than ₹15,000. They will be able to earn ₹ 3000 after the age of 60. The scheme will be called Pradhan Mantri Shramyogi Maan Dhan Yojana.

19. 2% interest subvention for farmers pursuing animal husbandry.

20. All farmers affected by severe natural calamities to get 2% interest subvention and additional 3% interest subvention upon timely repayment.

21. Decision taken to increase MSP (minimum support price) by 1.5 times the production cost for all 22 crops

22. The 22nd AIIMS to come up in Haryana

Conclusion: OfCourse idi elections ki mundu estunna era ani andariki telusu. Kani nearly 50-70% of middle class families and small taxpayers unna mana country lo ee budget chala help avtundi. Ee politicians em chesina cheyakapoina parvaledu kani common man kastalani konchem tagginchina chalu ade pedda varam.