The idea of a tech company nowadays is mostly on the bases of attraction, relaxed fashion style, cutting edge tech and a collaborative atmosphere which frees workers from stressful work. This vision is accurately what WeWork shows to people, WeWork uses rented out co-working offices to freelances, small business owners and even some tech giants. The company was an impressive fast-running startup on its way to issue an IPO in September 2019. Valued at 47 billion dollars, things were going great for WeWork until people started looking into the company and more importantly, their founder and CEO Adam Neumann from a failed IPO to a disgraced CEO. This company is a premature imitation tech giant which could be a downfall in the tech market.

The Birth of WeWork

Co-working has been a thing since the 90s and had been growing in popularity since 2005. Sailing on this sea, WeWork was founded in 2010, but what got the company fame right from the beginning was their ability to get into the market and trade an idea. It had open spaces and common areas which were very fresh. It never looked or felt like a traditional office as they mainly focused on the community that was drawing from their founder’s experiences growing up in communal living spaces.

Co-working has been a thing since the 90s and had been growing in popularity since 2005. Sailing on this sea, WeWork was founded in 2010, but what got the company fame right from the beginning was their ability to get into the market and trade an idea. It had open spaces and common areas which were very fresh. It never looked or felt like a traditional office as they mainly focused on the community that was drawing from their founder’s experiences growing up in communal living spaces.

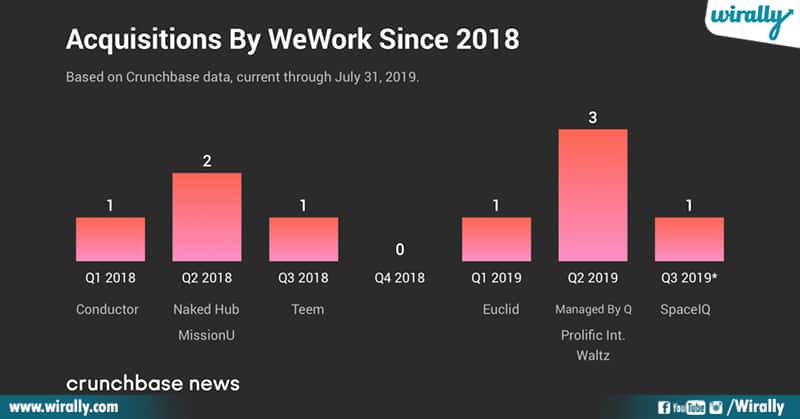

It structured itself as a tech company employing data analytic tools and other smart techs to improve the productivity of their areas. This led to an understanding of how exactly people use their spaces, building locations and the interior of the rooms. WeWork found a target market and increased rapidly in growth. The company got tremendous support from investors such as Goldman Sachs, JP Morgan and Softbank. Even Amazon invested in WeWork last year. Since 2009, WeWork secured 14.2 billion dollars in funding.

As low-interest rates made it easy for investment firms to invest in growing companies, one of these investors was Masayoshi Son, the CEO of Softbank. He manages a one hundred billion dollar vision fund. Masayoshi Son had made one of the most significant investments of all time just a few decades earlier when he gave Young Jack Ma 20 million dollars to fund Alibaba. In 2017, Masayoshi Son met with Adam Neumann for only 12 minutes before deciding to invest 4.4 billion in his tech company. He saw a new beginner in Adam Neumann, and Neumann saw a mentor in Masayoshi Son. Masayoshi Son had faith in Neumann, which could have played a role in his success but also could have played a part in his downfall.

The Growth of WeWork

Over the coming decades, WeWork used money from its investors to several 847 locations across 123 cities globally. WeWork was central London’s most famous office occupier and also the most significant private office tenant in Manhattan. But Adam Neumann had more significant hopes for the company than just renting office spaces.

Over the coming decades, WeWork used money from its investors to several 847 locations across 123 cities globally. WeWork was central London’s most famous office occupier and also the most significant private office tenant in Manhattan. But Adam Neumann had more significant hopes for the company than just renting office spaces.

Rebranding as the “We” company along with WeWork is also WeLive essentially renting a furnished apartment and more interestingly WeGrow, which in its own words is a “Conscientious Entrepreneurial School” for young children with tuition fees between 22,000-42,000 dollars. The school is related to stories and quotes committed to raising the awareness of the situations of the world. WeGrow is run by Rebecca Neumann, Adam Neumann’s wife and cousin of Gwyneth Paltrow. They are known as the founding parents to demonstrate the school’s uncertain powers.

WeWork has obtained much funding, but they didn’t make a profit yet. Although, after “Uber” went public in May, WeWork became the most valuable company in the United States. It’s common for a tech company to take a while to return a profit, but WeWork had framed itself as a tech company.

WeWork is effectively a landlord, and they don’t sell technology hardware or software, they rent office spaces. They use technology to make better and efficient business decisions, but these days most companies sell their technologies, and that was the main problem with WeWork. A landlord cannot make returns and growth and that too being a tech company.

The reason why the investors began to look at WeWork critically was that there was an essential and integrated risk with the company’s business plan. WeWork engages in an average lease of 15 years with a landowner. This means that WeWork pays a fixed amount each year for the land to lease. The company then charges people to use the space, if the property prices increase then WeWork makes money off the area.

If occupancy steeps too low or property prices fall, WeWork cant charge as much but they still have to pay the agreed lease, though this will make the company lose a large amount of money. WeWork as a company of subsidiaries which holds particular leases in different areas. That way if one subsidiary has to fail, it doesn’t affect the rest of the business.

Though, many people still believe that WeWork wouldn’t be able to defend themselves in the tales of other financial crisis where few people are willing to rent co-working spaces. Apart from this all, many reports have been stated for the company.

The Beginning of Downfall

The reports showed facts that became obvious to investors as WeWork was preparing for an IPO in September 2019. The problems started showing up in January with Softbank, which is a significant investor in WeWork. They took a step back on a proposed 16 billion dollars stake in the company, reducing that number to just 2 billion.

This decrease was blamed on a drop in Softbank’s share price, but some people were concerned that the Softbank was rethinking WeWork all together. As WeWork began its IPO filings, investors were keen to understand the root of the issue. During the process for filing for an IPO, the company required to disclose a lot of information to significant investors, this means financials, business models, disclosures, and other things. The company goes literally from private to public, and this was where the doubts of the 47 billion dollar judgment began.

The internal documents from WeWorks IPO filings revealed it was losing more than five thousand dollars per new customer. More details started coming out, and the company’s value dropped by nearly 80% just last year alone. Many blamed the financial situation, but there are also many doubts about the company’s founder and CEO Adam Neumann. As interest in the IPO grew, so he made the list of reports of not only about WeWork but also about Neumann himself from his use of drugs and alcohol to his disputes in the workplace.

Undefined Financials

Adam Neumann collected rent on properties that he owned himself from WeWork. He also borrowed hundreds of millions of dollars from WeWork at interest rates below 1%, and he purchased a sixty million dollar company jet despite the company losing 1.6 billion dollars that year.

He also sold millions of dollars of company shares over the years as if he didn’t have any faith or didn’t even bother about the company’s success. As reports came out, Neumann knew that he couldn’t control the damage as the investors were collectively pushing WeWork as a faulty investment. Statements about Neumanns character began crashing the news.

The IPO was put on an unclarified hold, and Neumann was forced out of the company and had to resign as the CEO. The sixty million dollar jet that Neumann bought was also taken away. It was shocking how Neumann still walked away from the company that he founded with 1.7 billion dollars while thousands of companies that invested in it may lose their jobs. In the end, the Softbank declared that they would have invested 15.4 billion dollars in the WeWork disaster, more than the gross domestic product of Jamaica.

Conclusion

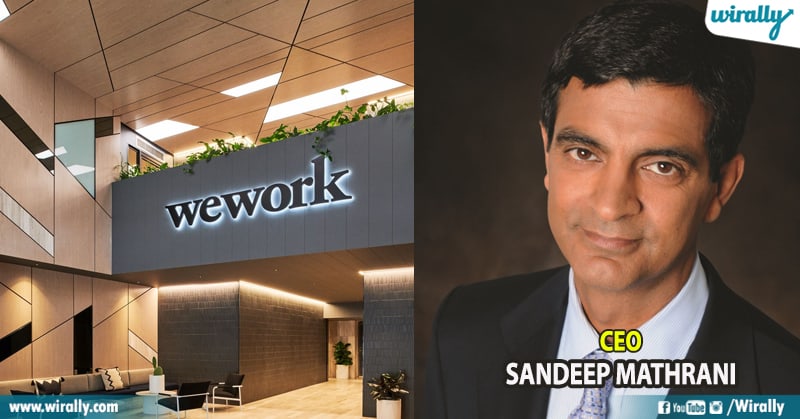

WeWork is in a challenging situation, and the business pattern is unsafe; it hasn’t gained any profit and investors just forced out the company’s charismatic yet reckless founder and CEO. The company is rapidly going out of cash and is in desperate need of investors. This resulted in a five billion dollar investment from Softbank in October 2019.

WeWork is in a challenging situation, and the business pattern is unsafe; it hasn’t gained any profit and investors just forced out the company’s charismatic yet reckless founder and CEO. The company is rapidly going out of cash and is in desperate need of investors. This resulted in a five billion dollar investment from Softbank in October 2019.

Now Softbank has control over the company. For WeWork to restart, their struggles towards an IPO may prove to be just as tricky as fixing the damage Neumann has caused. It is a genuine possibility that WeWork could be heading to the bankruptcy court that would be a disaster of epic proportions. In actual dollar terms, the fall of WeWork’s values is right on top of the list of failed companies like Enron, WorldCom, and Lehman Brothers.

Not only this, but it could move the base of the concept of investing in a unicorn company. Uber, Lyft, Slack, Dropbox, and Beyond Meat are all trading below their IPO prices. Fitbit traded 50 dollars per share after its IPO in 2015, but when Google recently bought it, it was only just 7 dollars a share. The exciting fact about WeWork is that it never made it to the public markets, and it seems that people are no longer willing to buy the hype of IPOs.

Also Read: Top Celebrities Who Are Billionaires