Credit Cards are life saviors, they provide attractive benefits in the form of reward points, cashback, fuel savings, insurance benefits, travel benefits, and so on. But, choosing a proper credit card that suits your needs can be a difficult task. Credit Card issues several cards each with its own set of benefits, and therefore we have shortlisted some of the famous or say top 10 credit cards in India with attractive benefits.

List of Top 10 Best Credit Cards in India, 2022

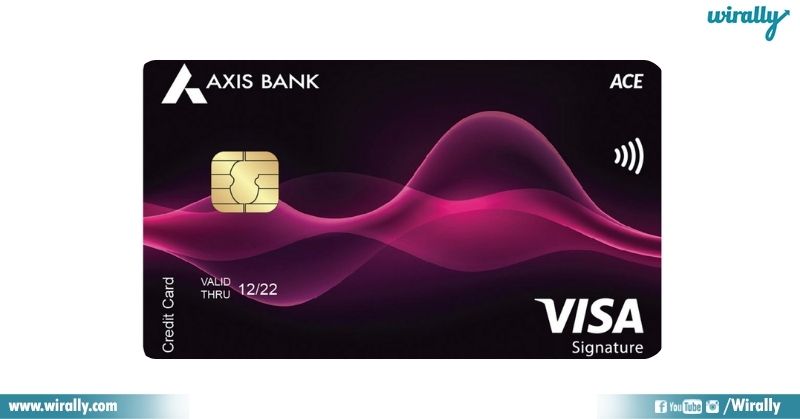

1. Axis Bank ACE Credit Card

With the highest universal cashback rate of 2%, Axis Bank Ace Credit is the best credit card in India. This card gives a 5% cashback on bill payments through Google Pay and the advantage is that there is no upper limit or lower limit to it. This credit card’s annual fee is low compared to the facilities it offers. The only card similar to this one is Standard Chartered Super Value Card, a little more expensive than this and at the same time has a double-sided cap to it. The joining fee is INR 499+18% GST (no annual fee if you spend INR 10,000 within 45 days of card issuance), and an annual fee of INR 499+18% GST is waived on an annual spend of more than INR 2,00,000, whereas the welcome benefit is INR worth Flipkart vouchers and 15% cashback up to INR 500 on Myntra. i.e., on your first transaction using a card.

2. SBI Card Elite

It is considered one of the best premium credit cards and a perfect companion to your lifestyle as it comes with exclusive shopping vouchers from some premium brands as a welcome gift along with movie ticket benefits, accelerated reward points, complimentary lounge visits, club Vistara membership and so on. Its annual fee is 4,999+GST, the renewal fee is 4,999+GST and the minimum income required is Rs. 60,000 per month.

3. Flipkart Axis Bank Credit Card

This is yet another best cashback credit card in the market and provides opportunities to avail benefits and discounts on travel, dining etc. Technically, there is not much difference between this card and Axis Bank Ace Card. an annual fee of INR 500 and the minimum income required is INR 15,000 per month. It provides 5% cashback on purchases made via Flipkart and Myntra and also 4 complimentary domestic lounge visits every year.

4. HDFC Regalia Credit Card

A credit that offers something for every category. HDFC Regalia offers a wide range of benefits on dining, travel, and shopping, a credit card for all-around benefits. With a joining fee of INR 2,500+GST, a renewal fee of INR 2,500+GST and minimum income required is INR 1 lakh per month. Though the annual fee is a little expensive, you get 2500 reward points on paying the annual fee. Every reward point is equal to 50 paise which means you can get half of the fee back as reward points.

5. Amazon Pay ICICI Credit Card

Another best co-branded credit card in India for a good cashback. If you shop often at Amazon, you have a higher chance of saving big on all your Amazon spending in the form of cashback. You can cashback from other spendings as well besides Amazon purchases. You will also get all the benefits free of cost i.e., There is no joining fee, renewal fee on this card. It best suits the needs of online shoppers.

6. HDFC Millenia Credit Card

This is a cashback credit card that offers cashback to cardholders on almost all transactions. It has been designed especially for people who like to shop online often. Besides cashback, cardholders can also avail the facility of complimentary lounge access. The joining fee of INR 1,000 and the annual fee of INR 1,000 and the minimum income requirement is INR 35,000 for Salaried and INR 6 lakh for self-employed. It provides 5% cashback on Amazon, Flipkart, Myntra, Swiggy, Zomato, TataCliq, Sony LIV, BookMyShow, Cult. fit, and Uber.

7. SBI SimplyClick Credit Card

A great credit card for a slow annual fee. The card covers mostly all the prominent shopping sites and reward points on shopping are quite good. The utility bills can be registered once and ensure timely bill payments thereafter. With an annual fee of INR 499 and a minimum income requirement of INR 20,000 per month. Its key benefits include an e-gift card worth Rs. 500 from Amazon as a welcome gift. And gives out 10 reward points per Rs. 100 on online shopping.

8. HDFC Cashback Credit Card

This is yet another best credit card for frequent shoppers who like to purchase now and then. This provides a generous cashback on all purchases. Its joining fee is zero and the renewal fee is INR 750+GST and the minimum income requirement is INR 4 lakh per annum. It provides a 5% discount of up to Rs. 250 every month on spending Rs. 1,000 and above. It also gives out benefits like an Amazon voucher of Rs. 500 and 50% discount up to Rs. 100 on the first transaction at Google pay as welcome benefits.

9. ICICI Platinum Chip Visa Credit Card

This is one of the best credit cards for first-time users. A basic credit card with simple benefits and easy reward redemption. With an annual of INR 99 and the minimum income, the requirement is INR 15,000 per month. Its key benefits include a 15% discount at partner restaurants and 2 payback points per Rs. 100 for all spends except fuel. The reward value on this credit card is Rs. 12,263 on annual spending of Rs. 4 lakh.

10. Axis Insta Easy Credit Card

One of the best credit cards for converting purchases to EMI along with accelerated rewards and easy redemption. With an annual of zero and the minimum income required is INR 20,000 FD. It provides 6 reward points on every Rs. 200 spent domestically and a 15% discount on dining in partner restaurants in India.